Argentina: dairy sector

This page contains data regarding key components of the Argentinian dairy industry over a given time period.

The following report:

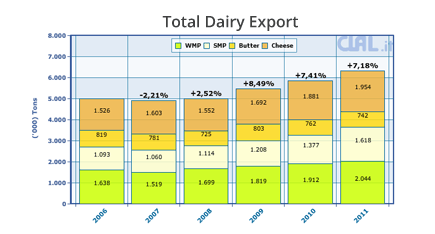

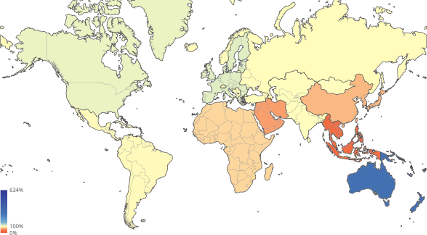

- highlights the complexity of the industry, which should be considered from several viewpoints: the commodities area, the variety of dairy derivatives, transit trade and domestic consumption;

- indicates how the export-import ratio is completely in favour of exports - of WMP in particular;

- stresses the particular features of a traditional product that is prevalent in domestic consumption: the dulce de leche.

| ARGENTINA: DAIRY SECTOR | ||||||||||

| x 1.000 ton | ||||||||||

| RAW MATERIAL AREA | 2020 | 2021 | 2022 | 2023 | 2023 | 2024 | % | Period | ||

| Number of dairy cows ('000) (Source: FAO) | 1.547 | 1.527 | 1.563 | |||||||

| Number of dairy cows ('000) (Source: Senasa) | 1.587 | 1.562 | ||||||||

| Milk production (Mil Lt) | 11.113 | 11.553 | 11.557 | 11.326 | 2.583 | 2.224 | -13,9% | Jan-Mar 2024 | ||

| Milk delivery (Mil Lt) | 10.329 | 10.739 | 10.743 | 10.528 | 2.416 | 2.081 | -13,9% | Jan-Mar 2024 | ||

| % Delivery on production | 93,0% | 93,0% | 93,0% | 93,6% | ||||||

| Farm gate milk price (€ x 100 lt) | 23,51 | 26,72 | 36,14 | 35,63 | 36,45 | 31,88 | -12,5% | Jan-Mar 2024 | ||

| ± % Over the same period of the previous year | +13,7% | +35,2% | -1,4% | |||||||

| Corn price (Rosario) (€\Ton) | 131,4 | 170,0 | 232,8 | 211,3 | 232,9 | 164,6 (p) | -29,3% | Jan-Apr 2024 | ||

| Soybeans price (Rosario) (€\Ton) | 225,6 | 286,5 | 406,0 | 409,9 | 416,8 | 281,4 (p) | -32,5% | Jan-Apr 2024 | ||

| DAIRY PRODUCTION | 2020 | 2021 | 2022 | 2023 | 2023 | 2024 | % | Period | ||

| Liquid milk (Mil Lt) | 1.254 | 1.199 | 1.168 | 1.152 | 276 | 225 | -18,7% | Jan-Mar 2024 | ||

Butter

|

35 | 41 | 39 | 34 | 7,4 | 6,0 | -18,7% | Jan-Mar 2024 | ||

Cheese

|

421 | 460 | 460 | 471 | 107 | 104 | -3,5% | Jan-Mar 2024 | ||

Hard cheese

|

33 | 37 | 38 | 42 | 9,6 | 9,8 | +1,7% | Jan-Mar 2024 | ||

Semi-hard cheese

|

126 | 151 | 156 | 161 | 36 | 36 | +0,6% | Jan-Mar 2024 | ||

Soft cheese

|

174 | 181 | 176 | 179 | 41 | 41 | -0,9% | Jan-Mar 2024 | ||

Processed cheese

|

59 | 58 | 57 | 59 | 13 | 9,7 | -27,0% | Jan-Mar 2024 | ||

| Other cheeses (grated, powdered, melted, etc.) | 28 | 32 | 33 | 30 | 8,0 | 7,7 | -2,7% | Jan-Mar 2024 | ||

WMP (Whole milk powder)

|

213 | 234 | 213 | 180 | 35 | 30 | -13,0% | Jan-Mar 2024 | ||

SMP (Skimmed milk powder)

|

52 | 55 | 51 | 31 | 7,9 | 7,6 | -3,9% | Jan-Mar 2024 | ||

| Cream | 61 | 61 | 66 | 63 | 14 | 13 | -5,0% | Jan-Mar 2024 | ||

| Dulce de leche | 107 | 97 | 102 | 104 | 22 | 21 | -5,6% | Jan-Mar 2024 | ||

| Milk chocolate (Mil Lt) | 23 | 40 | 46 | 34 | 10 | 8,6 | -15,5% | Jan-Mar 2024 | ||

| Dairy desserts and custards | 27 | 27 | 27 | 24 | 6,2 | 1,6 | -73,5% | Jan-Mar 2024 | ||

| Yogurt | 356 | 332 | 352 | 345 | 113 | 82 | -27,8% | Jan-Mar 2024 | ||

| EXPORT | 2020 | 2021 | 2022 | 2023 | 2023 | 2024 | % | Period | ||

| Whey powder (HS 0404) | TOP importers | 32 | 40 | 38 | 40 | 9,7 | 9,5 | -2,4% | Jan-Mar 2024 | |

| Butter (HS 0405) | TOP importers | 14 | 16 | 12 | 5,6 | 2,6 | 1,7 | -35,4% | Jan-Mar 2024 | |

| Cheese (HS 0406) | TOP importers | 44 | 52 | 57 | 64 | 15 | 18 | +17,7% | Jan-Mar 2024 | |

| SMP (skimmed milk powder - HS 040210) | TOP importers | 14 | 11 | 16 | 17 | 5,0 | 5,7 | +13,8% | Jan-Mar 2024 | |

| WMP (whole milk powder - HS 040221+040229) | TOP importers | 126 | 128 | 133 | 96 | 25 | 36 | +41,8% | Jan-Mar 2024 | |

| Casein (HS 350110) | TOP importers | |||||||||

| Infant milk formula (HS 190110) | TOP importers | 0,4 | 0,2 | 0,1 | 0,3 | 0,0 | 0,1 | 0,0% | Jan-Mar 2024 | |

| IMPORT | 2020 | 2021 | 2022 | 2023 | 2023 | 2024 | % | Period | ||

| Condensed milk (HS 040291+040299) | TOP exporters | 0,2 | 0,4 | 0,4 | 0,1 | 0,0 | 0,0 | -0,2% | Jan-Mar 2024 | |

| Whey powder (HS 0404) | TOP exporters | 0,8 | 1,1 | 1,0 | 1,1 | 0,3 | 0,4 | +30,8% | Jan-Mar 2024 | |

| Cheese (HS 0406) | TOP exporters | 1,1 | 2,8 | 4,6 | 2,9 | 1,1 | 0,5 | -53,0% | Jan-Mar 2024 | |

| Infant milk formula (HS 190110) | TOP exporters | 1,6 | 2,0 | 1,8 | 0,8 | 0,2 | 0,1 | -66,1% | Jan-Mar 2024 | |

| STOCK (at 31 December) | 2020 | 2021 | 2022 | 2023 | 2023 | 2024 | % | Period | ||

| Liquid milk (Mil Lt) | 40,9 | 51,7 | 41,0 | 37,1 | 38,4 | 25,1 | -34,8% | Feb 2024 | ||

Butter

|

4,6 | 4,1 | 5,2 | 4,1 | 3,7 | 3,6 | -4,1% | Feb 2024 | ||

Cheese

|

47,8 | 49,7 | 49,9 | 55,3 | 47,5 | 47,1 | -1,0% | Feb 2024 | ||

Hard cheese

|

13,6 | 14,2 | 15,5 | 18,5 | 15,5 | 17,5 | +12,8% | Feb 2024 | ||

Semi-hard cheese

|

15,2 | 18,3 | 18,0 | 20,2 | 17,5 | 16,5 | -5,5% | Feb 2024 | ||

Soft cheese

|

15,0 | 11,8 | 12,7 | 12,5 | 11,1 | 9,5 | -15,2% | Feb 2024 | ||

Processed cheese

|

1,6 | 3,0 | 1,5 | 2,1 | 1,6 | 1,6 | -2,3% | Feb 2024 | ||

| Other cheeses (grated, powdered, melted, etc.) | 2,3 | 2,4 | 2,1 | 2,0 | 1,8 | 2,1 | +12,1% | Feb 2024 | ||

WMP (Whole milk powder)

|

22,3 | 32,6 | 29,7 | 31,5 | 26,1 | 21,1 | -19,0% | Feb 2024 | ||

SMP (Skimmed milk powder)

|

5,8 | 7,2 | 8,7 | 5,9 | 8,9 | 4,9 | -44,8% | Feb 2024 | ||

| Cream | 1,5 | 2,0 | 2,4 | 1,5 | 2,1 | 1,5 | -28,9% | Feb 2024 | ||

| Dulce de leche | 5,5 | 5,7 | 5,9 | 5,3 | 4,8 | 4,0 | -16,0% | Feb 2024 | ||

| Milk chocolate (Mil Lt) | 2,4 | 5,5 | 8,4 | 3,8 | 4,7 | 3,7 | -21,3% | Feb 2024 | ||

| Dairy desserts and custards | 0,5 | 1,4 | 0,6 | 1,9 | 0,6 | 0,7 | +24,6% | Feb 2024 | ||

| Yogurt | 7,0 | 6,7 | 8,6 | 13,3 | 7,8 | 9,3 | +18,2% | Feb 2024 | ||

| DOMESTIC CONSUMPTION (Source: FAS-USDA) | 2020 | 2021 | 2022 | 2023 | 2023 | 2024(f) | % | Period | ||

| Cheese | 420 | 457 | 435 | 440 | 440 | 395 | -10,2% | Jan-Dec 2024 | Butter | 14 | 10 | 11 | 14 | 14 | 12 | -14,3% | Jan-Dec 2024 | SMP | 23 | 28 | 26 | 15 | 15 | 20 | +33,3% | Jan-Dec 2024 | WMP | 80 | 73 | 70 | 80 | 80 | 75 | -6,3% | Jan-Dec 2024 |

| PER CAPITA CONSUMPTIONS (kg) | 2020 | 2021 | 2022 | 2023 | 2023 | 2024(f) | % | Period | ||

| Cheese | 9,33 | 10,09 | 9,56 | 9,61 | ||||||

| Butter | 0,31 | 0,22 | 0,24 | 0,31 | ||||||

| SMP | 0,51 | 0,62 | 0,57 | 0,33 | ||||||

| WMP | 1,78 | 1,61 | 1,54 | 1,75 | ||||||

| % Self-sufficiency | 115,7% | 115,4% | 116,6% | 114,6% | ||||||

| SOCIO-ECONOMIC INDICATORS | 2020 | 2021 | 2022 | 2023 | 2023 | 2024(f) | % | Period | ||

| Population ('000) | 45.036 | 45.277 | 45.510 | 45.774 | ||||||

| GDP per capita (U.S. dollars) | 8.572 (e) | 10.632 (e) | 13.620 (e) | 13.297 (e) | ||||||

| GDP per capita (€) * | 7.500(e) | 8.989(e) | 12.934(e) | 12.298(e) | ||||||

* Per capita GDP in Euro is calculated by using the yearly average exchange rate

(p): partial data

(f): forecast

NOTE:Per capita consumptions are obtained dividing total consumption (Source FAS-USDA ) by the population (Source FAO)

Source Raw milk area: Subsecretaría de Lechería - Ministerio de Agroindustria; Number of cows: FAO, National Animal Health and Agrifood Quality Service (SENASA);

Source Dairy production: Subsecretaría de Lechería - Ministerio de Agroindustria, from 2015 data is collected by a panel of dairies according to "Relevamiento Coyuntural de la Resolución 230/16" and historical information of the "Resolución 7/14".

Source Export and Import: IHS

Source Consumption: FAS-USDA

GDP per capita: International Monetary Found

Source Population: FAO

Note: Self-sufficiency rate = Milk deliveries/(Domestic use in milk equivalent ME)

Domestic use in milk equivalent (ME) = Milk deliveries + Import in ME - Export in ME

Last update: 2024-04-24

.jpg)

.jpg)